The UK stamp duty holiday has been a blessing for some buyers and a nightmare for others. Over the past twelve months, the market has been on a hot streak, with property asking prices continuing to rise with little in place to prevent it from happening. Some newly released data could be the first signs that the streak could be coming to an end.

Contrary to most predictions, the UK property market has surged since the start of the pandemic. Many people now believe it has gotten out of control, with rampant price rises and properties getting snapped up within days of coming onto the market. However, there is some good news for those who want a semblance of normality back in the market. Asking prices could be levelling off and in some places, coming down.

In the early part of 2020, we published an article where we stated that contrary to many doom-mongers predictions of a property market catastrophe; we expected property prices to rise by a couple of per cent; how wrong we were! Asking prices in the UK over the past twelve months probably doubled our initial estimate. Since then, the market has shown little sign of slowing down, that is until now.

Although asking prices in some areas of the UK do seem to be falling, I still believe that more needs to be done. It has been muted recently that Capital Gains Tax rises might be imminent and, if implemented, could help to rapidly return the property market to its traditional, more sedate pace of growth.

What is behind the rise in prices?

Multiple factors have contributed to the rapid rise in asking prices, one of which was cash-rich second home buyers and buy-to-let investors snapping up properties in less built-up, lower-priced areas as somewhere to escape to and with a view to capitalise on their investment over the short to medium term. The knock-on effect from this was substantial asking price spikes in what were previously unfashionable areas, which permeated into adjacent areas with a similar make-up and in some cases, the unwelcome return of gazumping.

According to some news reports, new house builders, speculators and developers haven’t helped matters. With the market becoming red hot, they’ve been doing what is commonly known as ‘Land Banking’ which has helped to stoke the fire. This is where they buy up every available open space coming to the market; even it has been classified as green belt or farmland.

The pandemic effect

Some will say that the shut down of the market in 2020 and subsequent ‘bottleneck’ was the biggest contributor to the rise in asking prices. However, I feel it is a market, driven in the main by fear. Many homeowners who lived in sought after built-up urban areas saw prices were rising, and thought they were more at risk from catching the virus in heavily populated areas. They felt that now was the right time to ‘cash in’ and move somewhere that could offer them a less crowded and more sedate pace of life, such as villages and the open countryside.

Throw in, low borrowing rates and tens of thousands of buyers thinking that if prices continued to rise in the manner they were, the chance to buy a first or dream home would be all but gone, and the result was a red hot panic-driven market.

Over the past twelve months, we’ve written many articles about the property market, not with the view of pushing up prices but to help prevent the catastrophic crash that some experts had predicted. As we head into the latter part of 2021, some semblance of normality could be returning to the market. However, only time will tell.

The research showing the fall in asking prices

Recently, the estate agent comparison website, GetAgent.co.uk conducted some new research into asking prices. Their data has shown that asking prices are beginning to fall in many areas following the initial stamp duty holiday deadline at the end of June.

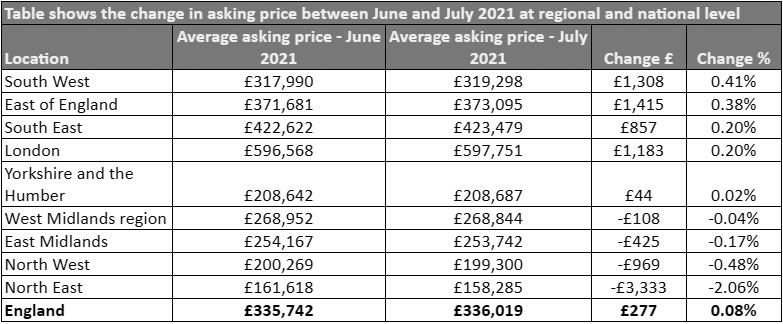

GetAgent’s analysis looked at the average asking price for homes listed on the market in June of this year when the stamp duty holiday was in full swing and how this compared to just one month later, once the tax-free threshold on a property purchase had been reduced to £250,000 from £500,000.

The figures show that after months on end of house price growth hitting record highs, asking prices across England saw growth of just 0.1% between June and July, with the average asking price increasing by just £277 to £336,019.

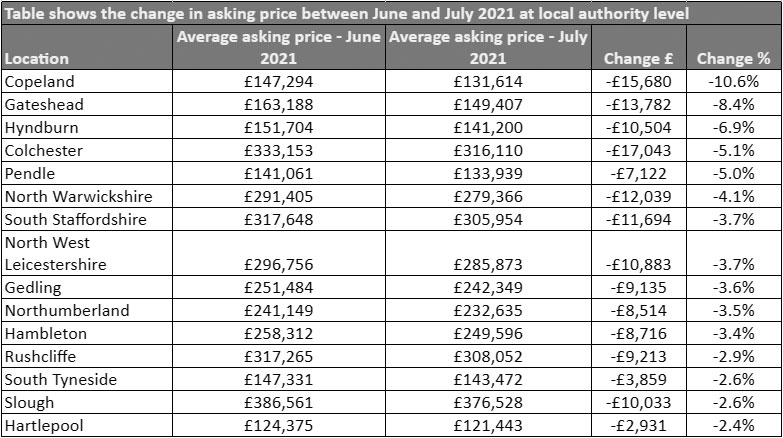

However, the analysis shows that as many as 46% of areas saw the average asking price decline and nowhere more so than in Copeland, where it fell by -10.6% in a single month.

Gateshead also saw one of the most significant declines in asking prices, down by -8.4% between June and July.

In Hyndburn, asking prices dropped by -6.9% in a single month, with Colchester (-5.1%) and Pendle (-5%) also seeing some of the most significant declines.

North Warwickshire, South Staffordshire, North West Leicestershire, Gedling and Northumberland also rank within the top 10 for the largest asking price declines following the initial extended stamp duty holiday deadline.

Colby Short, Founder and CEO of GetAgent.co.uk, commented, “The stamp duty holiday has been fuelling an incredible rate of house price growth pretty much since its introduction, and while it isn’t the primary motivation for buying a home, we’re certain to see some degree of downward correction as both extended deadlines expire.

In this case, the first deadline at the end of June led to an abrupt reduction in asking prices across many areas of the market, as sellers could no longer chance their arm to cash in on buoyant market activity driven by buyers with a little extra cash in their pocket during the negotiation stage.”

The next few months will show a much clearer picture of which direction the UK property is heading. Historically, once we get past September, activity in the market starts to cool in the lead-up to Christmas.

If we still see an unseasonably high level of activity with asking prices continuing to increase in a significant number of areas. In that case, I believe the Chancellor will have the perfect reason for raising CGT rates, and in my opinion, it won’t be a moment too soon.

The data shown in the tables above were sourced from PropertyData.

Read more property market guides and articles here.

![]()

You must be logged in to post a comment.