Central Plaza Hotel Public Company Limited sees strong recovery in both hotel and food business, with the Company announcing a Net Profit of Baht 152 million in Q4/2021 despite the COVID-19 pandemic.

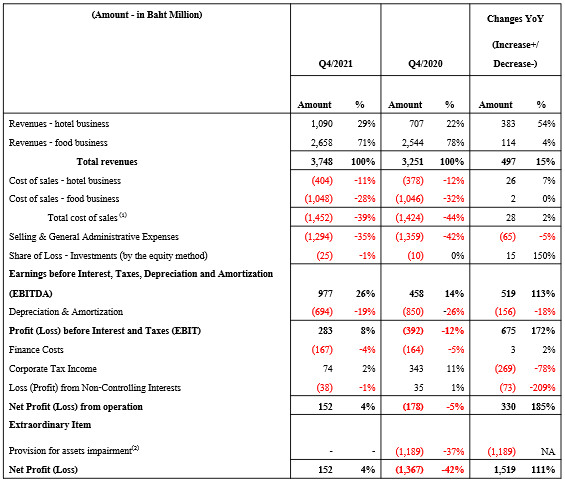

The Company achieved total revenues of Baht 3,748 million, an increase of Baht 497 million (or a rise of 15% YoY). The increase in revenue was from both the food and hotel businesses as a result of the re-opening of the country and lifting the restrictions of preventing the COVID-19 pandemic.

The Central Plaza Hotel Public Company Limited achieved the Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) of Baht 977 million, an increase of Baht 519 million (or 113% YoY) compared to last year. The improvement of EBITDA was due to both businesses’ continued efficient cost control, plus the recovery of hotel business both in Thailand and overseas, particularly a strong recovery trend in the Maldives. The Company had a net profit from the operation of Baht 152 million, which was an increase of Baht 330 million (or 185% YoY).

In 2022, even though the Omicron variant will continually impact the hotel business, it is expected impact that this will be less severe than the previous year because of increased vaccination, adopting a new normal life, and the reduction of Government restrictions policy.

Tourism is expected to be a gradual recovery, which depends on the international travel restrictions and the economic recovery. The Company expects the full-year average occupancy rate (Including Joint Venture) between 40% – 50% and Revenue per Available Room (RevPar) would be approximately Baht 1,700 – 1,900. The continued outperforming of hotels in the Maldives and Dubai and the rebound of Thailand tourism, particularly in the second half of 2022, are expected to be the key business drivers.

For the food business, the Company will be targetting the Same Store Sale (SSS) Growth and Total System Sale (TSS) Growth of between 10% to 15% and 20% to 25%, respectively, in 2022. For the outlet expansion, the Company estimates a net increase in the number of outlets of 180-200 outlets.

Operating Performance for Q4/2021 and Q4/2020

(1) Cost of Sales EXCLUDES Depreciation & Amortization Expenses that are allocated to Cost of Sales

(2) Provision for assets impairment is the number before deferred tax income of Baht 238 million in Q4/2020

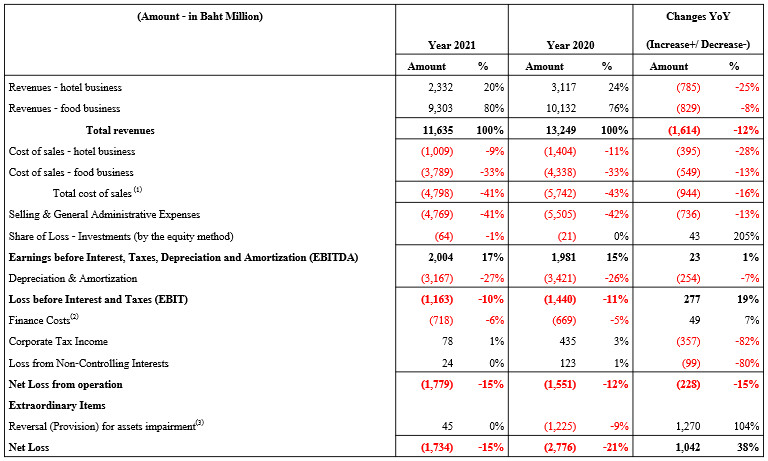

The year 2021: The Company achieved Total Revenues of Baht 11,635 million, a decrease of Baht 1,614 million (or a drop of 12% YoY. The Company achieved an EBITDA of Baht 2,004 million, an increase of Baht 23 million (or 1% YoY) that equated to an EBITDA Margin of 17%, which is an increase from the same period last year (2020: 15%).

The Company had a Net Loss from the operation of Baht 1,779 million, an increased loss of Baht 228 million or 15% YoY. As such, if the extraordinary item relating to the reversal (provision) of assets impairment were included, the Company would then have a Net Loss of Baht 1,734 million, a decreased loss of Baht 1,042 million, or 38% YoY.

(1) Cost of Sales EXCLUDES Depreciation & Amortization Expenses that are allocated to Cost of Sales

(2) Finance costs excluding interest expenses related to the leases are Baht 309 million in 2021 (2020: Baht 238 million)

(3) Provision for assets impairment is the number before deferred tax (expense) income of Baht (9) million (2020: Baht 245 million)

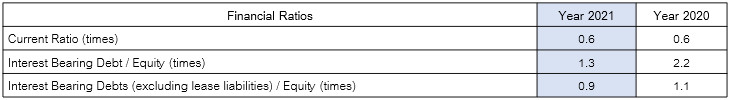

As of December 31, 2021, the Company’s current ratio was 0.6 times, the same as the end of 2020. Interest Bearing Debts / Equity Ratio decreased to 1.3 times, which was better than the end of last year, mainly as a result of an increase in equity due to the revaluation of land. The Company had Interest Bearing Debts (excluding liabilities related to leasing) / Equity of 0.9 times, which was well below the financial covenant with financial institutions at 2.0 times.

Current Company Information

As of December 31, 0 rooms) already in operation together with another 39 hotels (8,038 rooms) still under development. Of the 46 hotels already in operation, 19 hotels (5,050 rooms) are owned and operated by the Company, with the other 27 hotels (4,360 rooms) being operated under the Company’s Hotel Management Agreements.

As for the Food Business, CENTEL has a total of 1,389 QSR outlets, as follows:

- KFC (303 outlets)

- Mister Donut (424)

- Ootoya (46)

- Auntie Anne’s (197)

- Pepper Lunch (48)

- Chabuton Ramen (16)

- Cold Stone Creamery (16)

- Yoshinoya (27)

- The Terrace (14)

- 10. Tenya (14)

- Katsuya (49)

- Aroi Dee (37)

- Arigato (110)

- Kowlune (8)

- Grab Kitchen by Every Food (32)

- Salad Factory (18)

- Brown Café (14)

- Café Amazon – Vietnam (9)

- Som Tum Nua (7)

Read more hospitality news and features here.

![]()

You must be logged in to post a comment.