In what might come as a surprise to some, the latest Nationwide House Price Index has revealed that UK property prices have increased by 0.1%; however, on an annual basis, prices are still lower, down by 3.5% compared to the previous year.

Nationwide’s latest House Price Index, revealed today, has likely burst many bubbles.

Around the country, there’s probably been many newsdesks and journalists working through the night, who’ve been forming features with headlines proclaiming ‘doom and gloom’ for the UK property market, and it looks like those who did will be heading back to their keyboards, sharpish.

Below, Robert Gardner (right), the Chief Economist at Nationwide, offers his insight into the latest house price index:

“Annual house price growth was broadly stable at -3.5% in June, little changed from the 3.4% decline recorded in May.

“Prices were also fairly stable over the month, rising by a modest 0.1% after taking account of seasonal effects, reversing the 0.1% decline seen in May. (Note that June is typically the strongest month in terms of seasonal price rises; hence the change in the unadjusted cash price is larger than 0.1% in the table above.)

“Longer-term interest rates, which underpin mortgage pricing, have increased sharply in recent months in response to data indicating that underlying inflation in the UK economy is not moderating as fast as expected. This has prompted investors to expect the Bank of England to increase its policy rate further and for it to remain higher for longer.

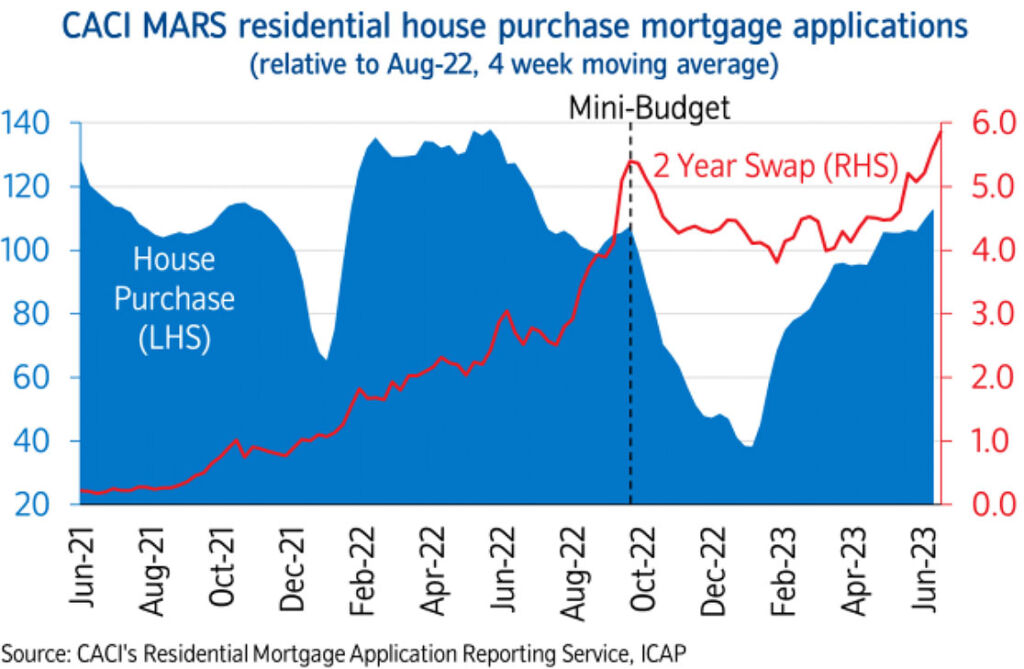

“Longer-term borrowing costs have risen to levels similar to those prevailing in the wake of the mini-Budget last year, but this has yet to have the same negative impact on sentiment. For example, the number of mortgage applications has yet to decline (as illustrated in the chart below), and consumer confidence indicators have continued to improve, though they remain below long-run averages.

Higher interest rates impacting affordability

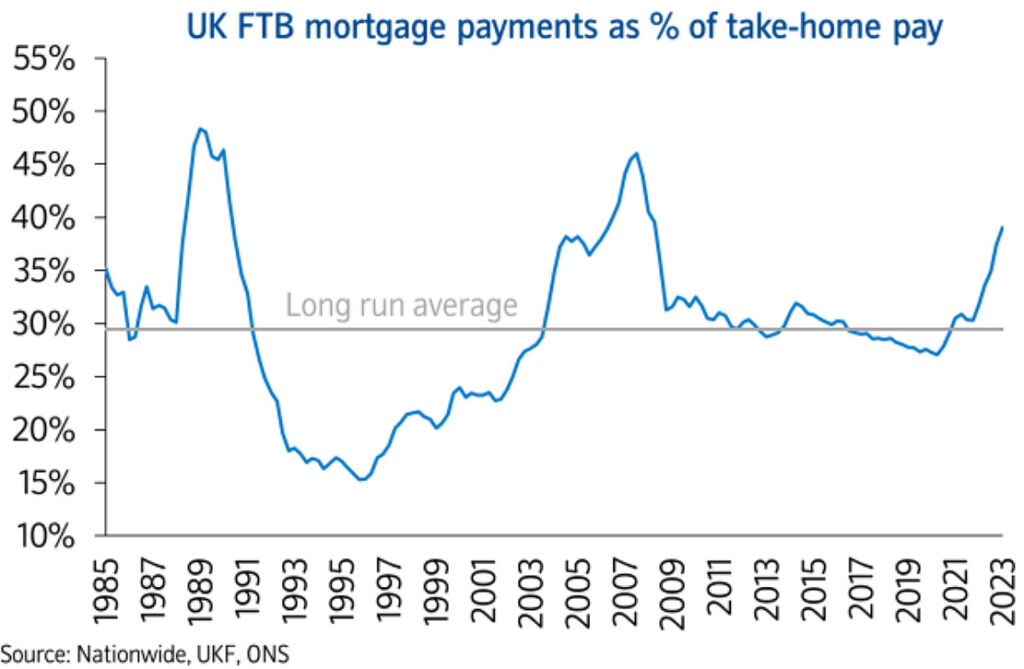

“The sharp increase in borrowing costs is likely to exert a significant drag on housing market activity in the near term. For example, for a representative first-time buyer earning the average wage and buying the typical property with a 20% deposit, mortgage payments as a share of take-home pay are now well above the long-run average, as illustrated in the chart below.

“Moreover, house prices remain high relative to earnings, and as a result, deposit requirements are still a significant barrier for those looking to enter the market. A 10% deposit on a typical first-time buyer home is equal to around 55% of gross annual income – this is down from the all-time highs of 59% prevailing in late 2022 but still marginally above the levels prevailing before the financial crisis struck in 2007/8.

“Despite the higher interest rates available to savers, the sharp rise in rents, together with continued high rates of inflation more generally, is continuing to make it difficult for many prospective buyers to save for a deposit.

Is a soft landing still possible?

“Nevertheless, a relatively soft landing is still possible, providing the broader economy performs as we (and most other forecasters) expect.

Labour market conditions are expected to remain relatively robust, with the unemployment rate remaining below 5%, while income growth is projected to remain solid. With Bank Rates likely to peak in the quarters ahead, longer-term interest rates should also start to fall back.

As a result, a combination of healthy rates of income growth and modest price declines should improve affordability over time, especially if mortgage rates moderate.”

Our View

The slight increase in house prices will come as welcome news for UK homeowners, who’ve been subjected to a raft of negative news headlines and wannabe experts proclaiming an imminent catastrophe on social media platforms.

We’re yet to see the full impact of the rising of interest rates, and it is highly probable that prices will fall by small percentages over the remainder of the year. However, we struggle to see the catastrophic price falls of 20%+ that some predict.

It should also be noted that any potential pain will not be shared equally. Should larger price drops occur during 2023, they are more likely to affect areas with over-inflated prices, such as the South of England. Other parts of the country*, for example, the Midlands and North, might not see any significant fluctuations in house prices.

In addition, we believe prices in areas such as *smaller towns (particularly market towns) throughout the country with good infrastructure are likely to hold up significantly better when compared to larger urban areas such as cities in the North and South.

Read more property news, guides and features here.

![]()

You must be logged in to post a comment.