Passion Investments can consist of just about anything. Over recent years classic cars, vintage toys, works of art, watches and jewellery have stolen the limelight, but is this still the case as we move through 2021? For the answer to this, we need to ask the experts, and there are few better to provide the answers than Arbuthnot Latham & Co.

It’s probably safe to say that all passion investments are booming and have been for the past couple of decades. Whether it’s nostalgia driving it or something entirely separate, no doubt buying the right thing can result in a significant return.

I’ve been one of the many who’ve embraced passion investments, and not in a small way. Over the past decade or so, I’ve built a collection of classic cars, an extraordinary collection of vintage toys, memorabilia, watches, rare whiskies, art, comics, pretty much anything you can name, I’ve collected it. Although all of this is securely stored off-site, it’s not been plain-sailing as my wife (below) hasn’t shared my passion for collecting.

Although my investing has slowed somewhat during the past year (for obvious reasons), I still believe that my passion investments will reap significant rewards in the future and the fun I get from it, is well worth the hassle of attending auctions and meetings with private collectors.

The appetite for passion investments is unlikely ever to go away, and it is becoming apparent that it is still expanding with new asset classes forming on a seemingly weekly basis.

When it comes to an up-to-date guide on Investments of Passion, we need information from the experts. For this feature, the advice comes courtesy of Arbuthnot Latham, who’s been around since 1833. It is the London-based private banking, commercial banking and wealth management arm of the Arbuthnot Banking Group PLC.

Over the past year, Arbuthnot Latham has observed a greater convergence between hobbies and investing. World Wealth reported that investors have continued to drive values for key collectable assets even through this pandemic.

Investments of passion are very often simply a hobby rather than part of a wider financial planning strategy. Exponential technological change and a huge increase in retail investors have persistently created volatility and unpredictability in new asset classes.

What is certain is that the lines between investments of passion and investments of pure purpose have become more blurred. So, what exactly have people been interested in:

Non-Fungible Tokens (NFTs)

According to the market tracker, 134,191 sales took place in March 2021, with collectors spending more than US$200 million trading artwork, gifs and memes. The platform is a great way for artists to launch their careers and be remunerated for their work.

Unsurprisingly, NFTs have caught the eye of many companies ready to push boundaries and unlock potential, from cryptocurrency for entertainment and sports to tapping into the collectables market targeted at football fans, or even virtual real estate, with a digital home selling for as much as US$500,000 recently.

Toys

An unopened and forgotten copy of Super Mario Bros. for the Nintendo Entertainment System, a Christmas gift from 1986, was sold in an auction for US$660,000 last month. The gift was left unopened for 35 years!

Pokémon trading cards grew hugely in popularity during the COVID-19 pandemic. A rare, 1st edition ‘Charizard’ card sold for $360,000. Forbes reported that for some less unique cards, the selling rate could vary between US$400 and US$2000.

Star Wars collectables have also caught the eye of many. In 2019, a Star Wars’ Bib Fortuna’ toy prototype sold for £36,000 alongside other characters, all of whom were said to be “relatively unknown”.

Books

Well kept, original, limited edition items have sold in auctions for hundreds of thousands of pounds – in some cases even millions. Indeed, the first comic book ever to feature Superman sold on eBay for over US$3.25 million. The original was on sale for 10 cents in 1938.

Harry Potter books are also proving to be a unique investment, but there is a catch. Only 500 copies of the first edition were originally printed, and it was not long until a spelling error was spotted in the book. In 2020, one of these copies, published in 1997, bypassed the original valuation of £30,000 and sold for £60,000.

Vintage Baseball Cards

Mint condition cards sold on US marketplace StockX soared in average price in 2020, from US$280 to US$775 per card. Just last month, a one of 100-of-its-kind card of athlete, Tom Brady, sold for US$1.3 million.

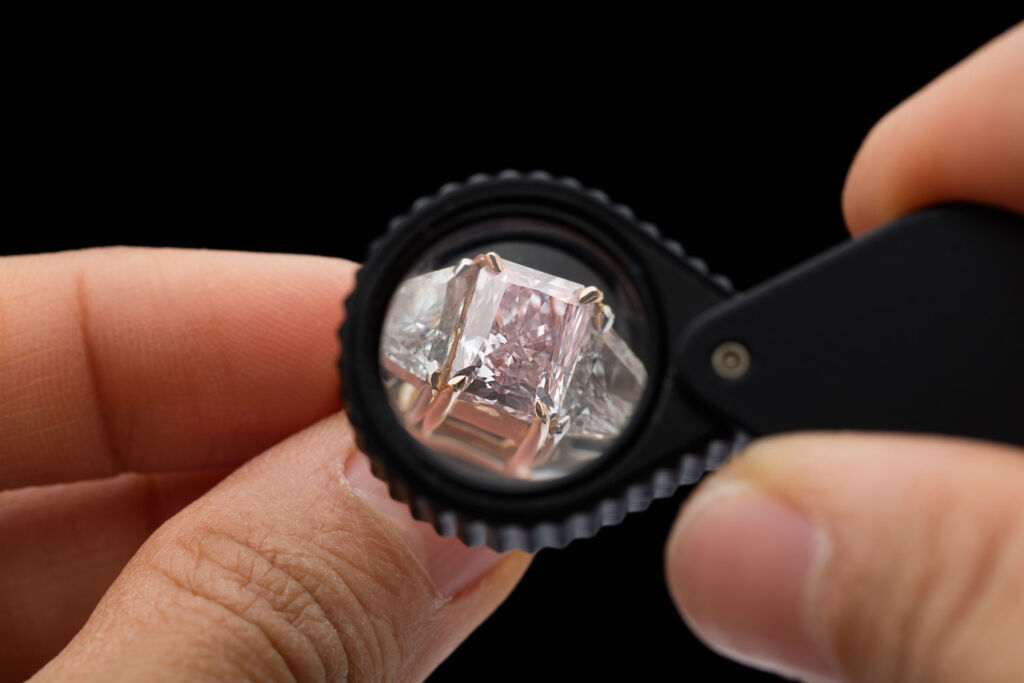

Jewellery

Coloured diamonds have been deemed the safest bet for return on investment. The largest-ever auctioned piece was a 14.8-carat purple-pink diamond which sold for £20.1 million in 2020 in Switzerland; Showing that the market stayed strong despite the pandemic.

Trainers

Trainers too, have earned their place as an investment category. In England, the Kayne West x Louis Vuitton collection of trainers are estimated as the most valuable at £22,763. If you do own a pair, we hope that you chose the grey and pink, as these are the most sought-after. In the US, a pair of trainers in the style of the famous Nike dunks sold in March for the equivalent of £24,000.

Nick Gornall, Arbuthnot Latham’s Head of Business Development, added, “Traditionally, passion investments would have included fine and contemporary art, wine, watches, jewellery classic and supercars, all of which would suggest a level of knowledge and major issues around authenticity, storage, tax and insurance.

“In a world that has seen historically low levels of interest rate post-2008, and with the globalisation of investors, particularly from China accessing via technology, there is renewed interest and more transparent market platforms for such passion investments.

“It is not a surprise to see many more emerging trends – what price will be paid in 30 years’ time for the prototype electric car or digital footprint for today’s Instagram influencer, I wonder. We live in interesting times.”

Read more articles on investments and finance here.

![]()

You must be logged in to post a comment.