The latest research from Moneyfacts.co.uk reveals that savers can almost double the amount of interest earned by switching from a closed account to the top easy access deal today.

Given the chance, who wouldn’t want to double the amount of interest they’re earning?

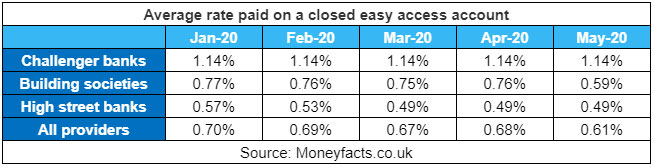

The challenger banks dominate not only the top rate tables today, but they also pay the best closed rates in comparison to their peers on easy access accounts. Fortunately, Moneyfacts is on hand to not only remind us to search the market, they’ll also point us in the direction of the best available deals.

How you can almost double the amount of interest earned by switching

The average rate for an easy access account that is closed to new business is 0.61%, compared to the best easy-access rate, which is available today of 1.20%. This means that those with a balance of £85,000 could earn an additional £501.50 in interest over 12 months by merely switching.

The gains to be made by switching on this basis should, therefore, be a positive incentive for savers, especially if the returns on closed easy access accounts continue the downward trend seen throughout 2020 so far.

Rachel Springall, a Finance Expert at Moneyfacts.co.uk, said: “It is clear to see that there is a big incentive for savers to switch from a closed account to the top deal, but they must move quickly as the easy access market continues to experience rate cuts.

“The challenger banks dominate not only the top rate tables today, but they are also paying the best closed rates compared to their peers on easy access accounts. In fact, the top easy access rate today comes from a challenger bank, RCI Bank UK, which pays 1.20%, whereas some high street banks such as NatWest pay as little as 0.01%. Challenger banks pay 1.14% on average on closed easy access accounts, compared to 0.61% for all providers.

“Savers with their cash in either a closed or live account with a high street bank may then wish to consider switching. It can take up to three months for a base rate change to trickle through the savings market, and since February 2020, the average high street bank closed easy access rate has fallen from 0.53% to 0.49%, so savers could be better off switching than remaining loyal.

“As the market feels the impact of two base rate cuts, it is important savers do not become discouraged from hunting down the top deals available to them. In fact, the easy access market has had two new deals enter the top 10 recently, both from challenger banks, with Shawbrook Bank and Ford Money paying 1.15% and 1.07% respectively. Clearly, savers will need to look beyond the high street banks and consider the less familiar brands to find a better deal.”

Read more finance-related articles in our dedicated section here.

![]()

You must be logged in to post a comment.