It’s still full steam ahead for the UK property market. According to the Rightmove October 2020 House Price Index, prices of properties listed are now £16,818 (5.5%) higher than they were a year ago and for the first time, estate agents have more properties marked as sold than available for sale.

Rewind to the first quarter of this year, when the news of the pandemic was first starting to dominate the headlines, who’d have thought that we would be reading about new records set in the UK property market? If you’d listened to many of the so-called analysts and self-proclaimed property experts, you would be expecting us to write articles using words such as catastrophe and carnage in the main title. However, this is far from the case.

What does the Rightmove October 2020 HPI tell us?

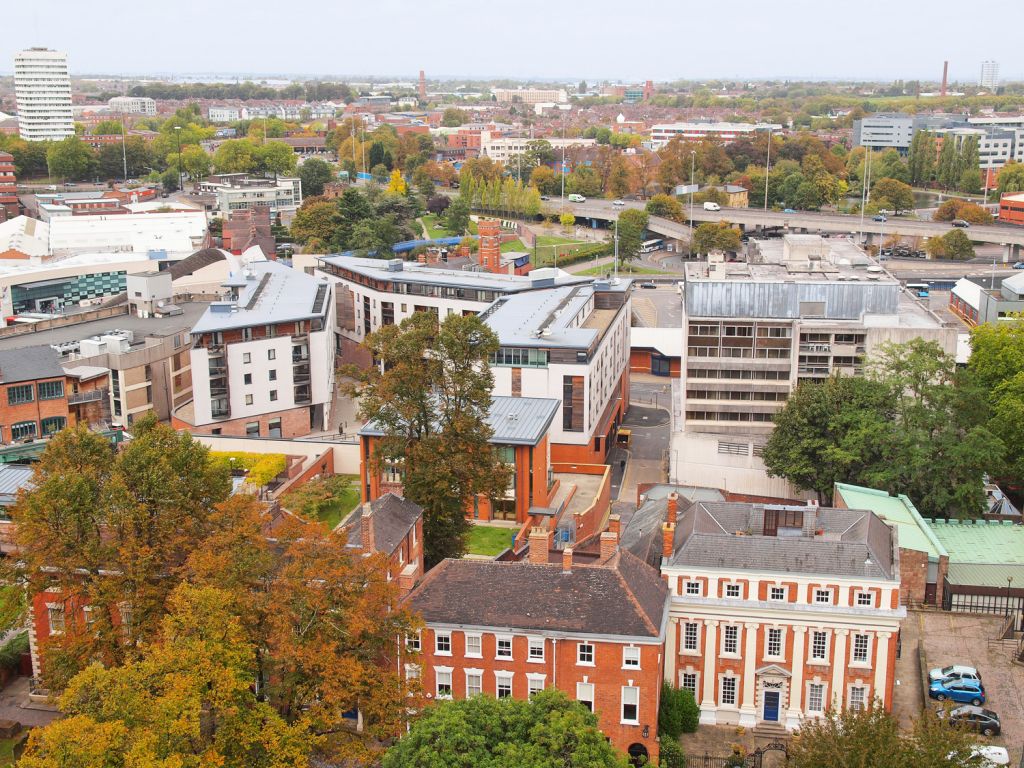

First and foremost, Brits are on the move. We recently published a detailed article about the change in appetite for the London property market, explaining why it had lost its lustre. London is not an isolated case; many people who are living in cities and built-up urban areas are actively seeking more space and looking towards greener pastures.

Although the property market was closed between late-March and mid-May this year, the frenzy we are currently witnessing is not solely down to pent-up demand. There is a significant number of new buyers coming onto the scene seeking more space which is allowing us in the press to utilise the words mini-boom and boom times.

The pandemic has obviously prompted people to reevaluate, and many are opting for a better quality of life rather than a prestigious postcode. In addition, the UK Government’s stamp duty holiday has helped no end and the much-maligned lenders have stepped up to the plate which has and is, encouraging more buyers to the market.

The North of the country

The Rightmove Oct 2020 HPI shows that it is a slightly mixed bag when it comes to the North of England. Surprisingly there has been a fall of 1.6% in prices in the North East; however, the annual change is very much in positive territory, up by 6.4%. The Yorkshire and Humber area join the North East in being one of the only two regions showing a negative figure. Yorkshire and Humber recorded a small dip of 0.1% over the month, but this can be overlooked when you look at the impressive +7.4% annual change.

As expected, the North West region continues to power on, helped by the fact that it offers some of the best value for money in the country and is the area picked out by many property groups as providing the largest potential upside over the next few years. The region recorded a monthly change of +1.1% with a +7% annual increase.

We asked Michael Bailey (left) for his thoughts on which direction the North West property market is heading;

“It’s incredible what we’re experiencing here in the North West and we’re frequently finding ourselves with more enquiries than we can cope with. The right properties are generating a tremendous amount of interest and it’s not uncommon for there to be multiple buyers trying to outbid each other for the same property.

Correct pricing is paramount, and we have had to reign in the expectations of some sellers. However, in comparison to almost every other area of England, property here in the North West is almost unmatched when it come to value for money and with the superb transport links and the Government’s commitment to the region, over the medium-term, I can only see prices going one way, and that is up.”

The Midlands is also in positive territory led by some stellar numbers in the East Midlands. The region showed a monthly change of +1.4% and this is coupled with a hugely impressive annual increase of +7.7%. The West Midlands was up slightly on the month by 0.3% showing an annual change of 6.3%.

One of the leading voices in the Midlands property market is James Forrester (right), the Managing Director of Barrows and Forrester. He said; “While the current stamp duty holiday has acted as the carrot required to lure cautious buyers back to the market, many home sellers have also seen it as an opportunity to try their luck and secure a higher price than they may otherwise have dreamt of back in March.

As a result of this over-optimistic pricing tactic, asking prices have soared, and buyers are ironically seeing the stamp duty saving on offer dwindle in their attempts to secure a property before the deadline arrives.

While the time to accept an offer is incredibly quick at present, the time required to complete and secure a stamp duty saving is not. Therefore those entering the market now are unlikely to complete in time to ensure a stamp duty saving and as this reality starts to filter through to homebuyers, asking price growth will cool considerably.”

![]()

A more detailed breakdown of the property market by region:

- Scotland has seen a ↑0.6% monthly change, the annual rate of increase is ↑8.7%, and the average number of days to sell is 31.

- The North West has seen a ↑1.1% monthly change, the annual rate of increase is ↑7.0%, and the average number of days to sell is 51.

- The East Midlands has seen a ↑1.4% monthly change, the annual rate of increase is ↑7.7%, and the average number of days to sell is 52.

- The West Midlands has seen a ↑0.3% monthly change, the annual rate of increase is ↑6.3%, and the average number of days to sell is 48.

- The East of England has seen a ↑1.7% monthly change, the annual rate of increase is ↑5.3%, and the average number of days to sell is 52.

- Wales has seen a ↑0.6% monthly change, the annual rate of increase is ↑7.0%, and the average number of days to sell is 60.

- London has seen a ↑0.2% monthly change, the annual rate of increase is ↑2.6%, and the average number of days to sell is 48.

- The South West has seen a ↑1.7% monthly change, the annual rate of increase is ↑5.5%, and the average number of days to sell is 52.

- The South East has seen a ↑1.1% monthly change, the annual rate of increase is ↑4.4%, and the average number of days to sell is 53.

![]()

All things considered, London is lagging behind

Of the 32 areas of London listed in the Rightmove Index, half showed a fall in monthly house prices with only Haringey, Bromley and surprisingly, Westminster showing a monthly increase of more than 1%. The standout area in negative terms is Kensington and Chelsea which has recorded an annual change of -7.1% and a monthly fall of -2.4%.

Marc von Grundherr, Director of Benham and Reeves (left) says; “There’s no doubt that this extraordinary market revival has put UK home sellers back in the driving seat, with huge levels of buyer demand boosting asking prices considerably.

Marc von Grundherr, Director of Benham and Reeves (left) says; “There’s no doubt that this extraordinary market revival has put UK home sellers back in the driving seat, with huge levels of buyer demand boosting asking prices considerably.

This demand is being driven by the desire for more space and larger homes. However, it seems as though some sellers are starting to push their luck in this respect, with anyone and everyone increasing their asking price expectations whether or not it can be justified.

London continues to recover at a slower rate when compared to the rest of the nation due to lack of both professional and international demand. However, all things considered, the capital is holding its own where topline price growth is concerned. This is hugely positive news given the fact it has been arguably the worst-hit region and bodes very well for the market once a greater degree of normality returns.”

![]()

The main highlights in the Rightmove HPI:

- Average time to sell of 50 days is quicker than ever before, leaving agents with more properties marked as sold than available for sale for the first time ever.

- The highest number of sales ever agreed in a month, up 70% on September last year.

- Traffic to Rightmove is up almost 50% in September 2019, and this is the biggest annual jump since 2006.

- Number of active buyers 66% higher than a year ago, down marginally from 67% July peak.

- The pace of growth is easing, but sales agreed for October so far still up 58% on the same period last year.

![]()

Other points to note is the number of active buyers is remaining steady at a record level, and although we haven’t completed the month, the number of sales agreed in October is already 58% up on the same period last year.

On the subject of the 5.5% price increase, Tim Bannister, Rightmove’s Director of Property Data believes we’ve not yet seen the peak; “We predict that the annual rate of growth will peak by December at around 7% higher than a year ago. Many buyers seem willing to pay record prices for properties that fit their changed post lockdown needs. However, agents are commenting that some owners’ price expectations are now getting too optimistic, and not all properties fit the must-have template that buyers are now seeking. Not only is the time left to sell and legally complete before the 31st March.”

As a result of this over-optimistic pricing tactic, asking prices have soared, and buyers are ironically seeing the stamp duty saving on offer dwindle in their attempts to secure a property before the deadline arrives.

While the time to accept an offer is incredibly quick at present, the time required to actually complete and secure a stamp duty saving is not. Therefore those entering the market now are unlikely to complete in time to secure a stamp duty saving and as this reality starts to filter through to homebuyers, asking price growth will cool considerably.”

Final thoughts…

How long this positivity will last for is, in my opinion, down to the best guess. The pandemic has been the main driving force in people wanting to move, and I believe in the near-term, people will still be seeking more space and greenery, even if a vaccine is widely available. Millions have now experienced a warning shot across the bow, and there is a good chance that something else nasty will come along in the years to come.

A large portion of the population is now comfortable with remote working using video technology, and this has inherently changed views on where to live and work. I believe, is not good news for major urban areas and we will continue to see an exodus over the next few years.

As yet we’ve not experienced the full impact of the rising unemployment, and at some stage, this will likely cause a throttling back of the property market engine. However, with Rightmove predicting a +7% increase by the end of the year, there would seem to be little sign of things easing off, so my advice is; if you are thinking of selling make hay while the sun shines.

Read more property market guides and articles relating to Rightmove data in our dedicated section here.

![]()

You must be logged in to post a comment.